BAS Due Dates 2025: Comprehensive Overview

Estimated reading time: 5 minutes

Key Takeaways

- Understanding BAS due dates for 2025 is crucial for Australian businesses to remain compliant.

- BAS reporting cycles can be monthly, quarterly, or annually, depending on your business.

- Using a registered tax agent can provide extended deadlines and ensure compliance.

- Accurate and timely BAS lodgment helps avoid penalties and keeps business operations smooth.

Table of Contents

- Understanding BAS

- BAS Reporting Cycles

- Lodgment Methods

- Special Notes

- Quick Reference for Key 2025 BAS Filing Dates

- Frequently Asked Questions

Understanding BAS

Business Activity Statements (BAS) are periodic tax reporting forms that Australian businesses must submit to the Australian Taxation Office (ATO). They cover various taxes including Goods and Services Tax (GST), Pay As You Go (PAYG) withholding, and other obligations. To avoid common pitfalls when managing your BAS, refer to Common BAS Errors & How to Avoid Them.

BAS Reporting Cycles

Depending on the size and nature of your business, you may report and pay BAS monthly, quarterly, or annually. It’s vital to understand these timelines to maintain compliance and avoid potential penalties. For detailed steps on lodging your BAS, consult How to Lodge a Small Business Tax Return in Australia.

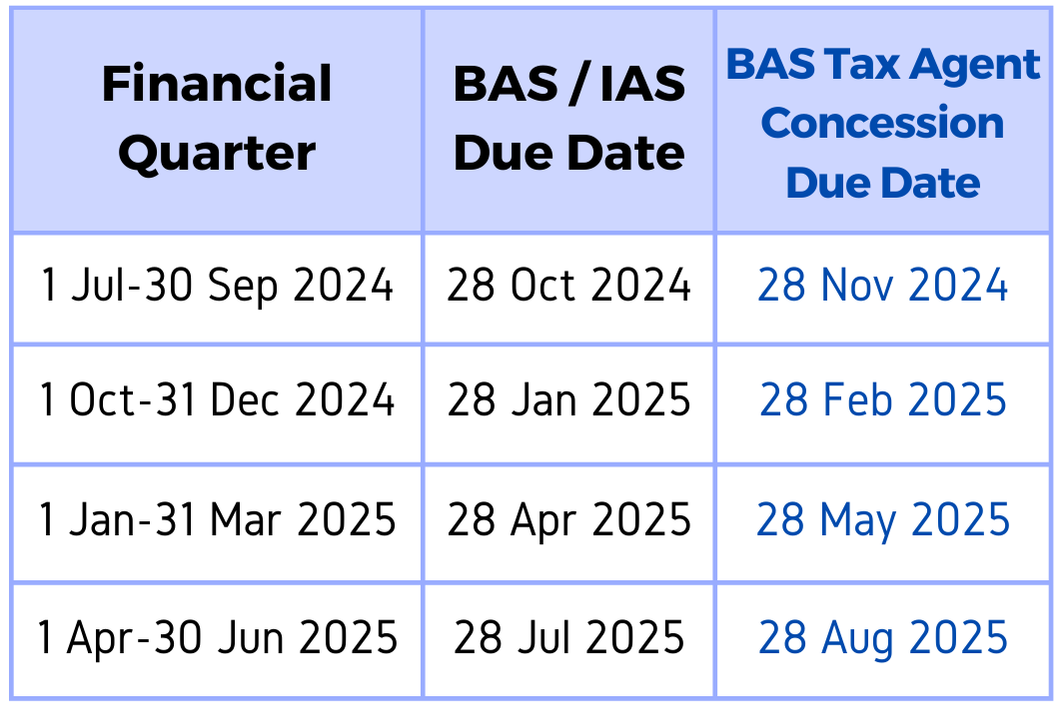

Quarterly BAS Due Dates for 2025

Here are the specifics for each quarter:

- Q3 (Jan–Mar 2025): If you are lodging yourself, the due date is 28 April 2025. However, using a registered agent extends this deadline to 26 May 2025. Sheppard Advisory provides these dates, with additional guidance available from Jaha.

- Q4 (Apr–Jun 2025): The self-lodged deadline falls on 28 July 2025, and the agent-lodged deadline is 25 August 2025, details confirmed by both Sheppard Advisory and Jaha.

- Q1 (Jul–Sep 2025): Deadline for self-lodging is 28 October 2025, with agents having until 25 November 2025 to lodge. This is detailed on Sheppard Advisory and Jaha.

- Q2 (Oct–Dec 2025): Lodgment dates are 28 January 2026 for self-lodging and 25 February 2026 for agent-lodged, as noted on Sheppard Advisory and Jaha.

If a due date falls on a weekend or public holiday, it typically extends to the next business day. You can find more about extended lodgment guidelines on Sheppard Advisory.

Monthly BAS Due Dates for 2025

For businesses that file monthly, the BAS is due on the 21st day of the month following the end of the taxable period:

- January 2025 BAS: Due on 21 February 2025

- February 2025 BAS: Due on 21 March 2025

- March 2025 BAS: Due on 21 April 2025

These due dates hold for each month throughout the year, with details available from ATO, AOne Outsourcing, and Sheppard Advisory. Additionally, to maximize your tax deductions while preparing your BAS, check out Small Business Tax Deductions Australia: Maximise Your Claim and Reduce Your Tax.

Annual BAS Due Date for 2024–2025

The annual BAS for the financial year is due by 31 October 2025 if not lodging with a tax return. If included with your tax return, the due date for the tax return applies. More information is available on this topic at AOne Outsourcing.

Lodgment Methods

You have several options for lodging your BAS:

- ATO Online Services: Includes the Business Portal, myGov for sole traders, or SBR-enabled software.

- Registered BAS or Tax Agent: Engaging a professional can provide extended due dates and ensure compliance. Learn more about the benefits of using a registered tax agent in Why Every Small Business in Australia Should Hire a Registered Tax Agent.

Details on these methods can be found on AOne Outsourcing.

Special Notes

- Agent Concessions: Using a registered BAS or tax agent can grant you extra time for quarterly lodgments.

- December Monthly BAS: For businesses with an annual turnover below $10 million using an agent, the December monthly BAS can be lodged by 21 February of the following year.

These concessions are outlined in detail in resources from Sheppard Advisory and Jaha, as well as AOne Outsourcing.

Quick Reference for Key 2025 BAS Filing Dates

To summarize key dates:

- 28 April 2025: Q3 BAS due (self-lodged)

- 26 May 2025: Q3 BAS due (agent-lodged)

- 28 July 2025: Q4 BAS due (self-lodged)

- 25 August 2025: Q4 BAS due (agent-lodged)

- 21st of each month: Monthly BAS due for the previous month

It is imperative to refer to official ATO resources or consult with your registered tax agent for the most accurate and detailed schedule fitting your specific business needs. This ensures that your compliance is on track and penalties are avoided, keeping your business operations smooth and stress-free.

Frequently Asked Questions

What happens if I miss a BAS due date?

If you miss a BAS due date, the ATO may impose penalties and interest charges. It’s essential to lodge even if you can’t pay to minimize penalties.

Can I change my BAS reporting cycle?

Yes, you can apply to the ATO to change your reporting cycle, but approval will depend on your business turnover and other factors.

Do registered tax agents get additional time to lodge BAS?

Yes, using a registered tax agent often provides additional time to lodge due to agent concessions granted by the ATO.

Is it mandatory to lodge BAS electronically?

While electronic lodgment is encouraged for its convenience and speed, it’s not mandatory. You can still lodge via paper forms if preferred.

Where can I find more information on BAS due dates?

You can visit the ATO website or consult with a registered tax agent for personalized advice.

}