Cryptocurrency Tax Calculator: Your Ultimate Guide to Navigating Crypto Taxation

Estimated reading time: 9 minutes

Key Takeaways

- Cryptocurrency tax calculators simplify compliance with Australia’s complex crypto tax rules.

- They automate capital gains, losses, and crypto income calculations, saving time and reducing errors.

- Leading platforms offer robust features including multi-exchange data imports and tax form generation.

- Australia-specific crypto tax tools are crucial for optimal cryptocurrency tax australia solutions.

- Manual tracking is risky; specialist crypto tax calculators ensure compliance and peace of mind.

Table of contents

- Cryptocurrency Tax Calculator: Your Ultimate Guide to Navigating Crypto Taxation

- Key Takeaways

- What Is a Cryptocurrency Tax Calculator?

- Why Do You Need a Cryptocurrency Tax Calculator?

- Key Features of Cryptocurrency Tax Calculators

- Popular Cryptocurrency Tax Calculators

- How to Use a Cryptocurrency Tax Calculator

- Limitations of Crypto Tax Calculators

- Frequently Asked Questions

What Is a Cryptocurrency Tax Calculator?

A cryptocurrency tax calculator is a specialized online tool or software that helps estimate taxes owed on crypto transactions, including trades, sales, mining, staking, and airdrops. By inputting details like acquisition and sale dates, cost basis, and transaction types, you can quickly calculate your cryptocurrency tax australia.

Unlike spreadsheets, crypto tax calculators account for nuances like token swaps, chain forks, staking rewards, and mining income, and their varying tax treatments. As Australian regulations evolve, these tools are essential for all crypto investors.

Why Do You Need a Cryptocurrency Tax Calculator?

- Complex Tax Rules: Australian tax law treats cryptocurrency as property, not currency. Each sale or disposal is a taxable event, making manual tracking extremely difficult.

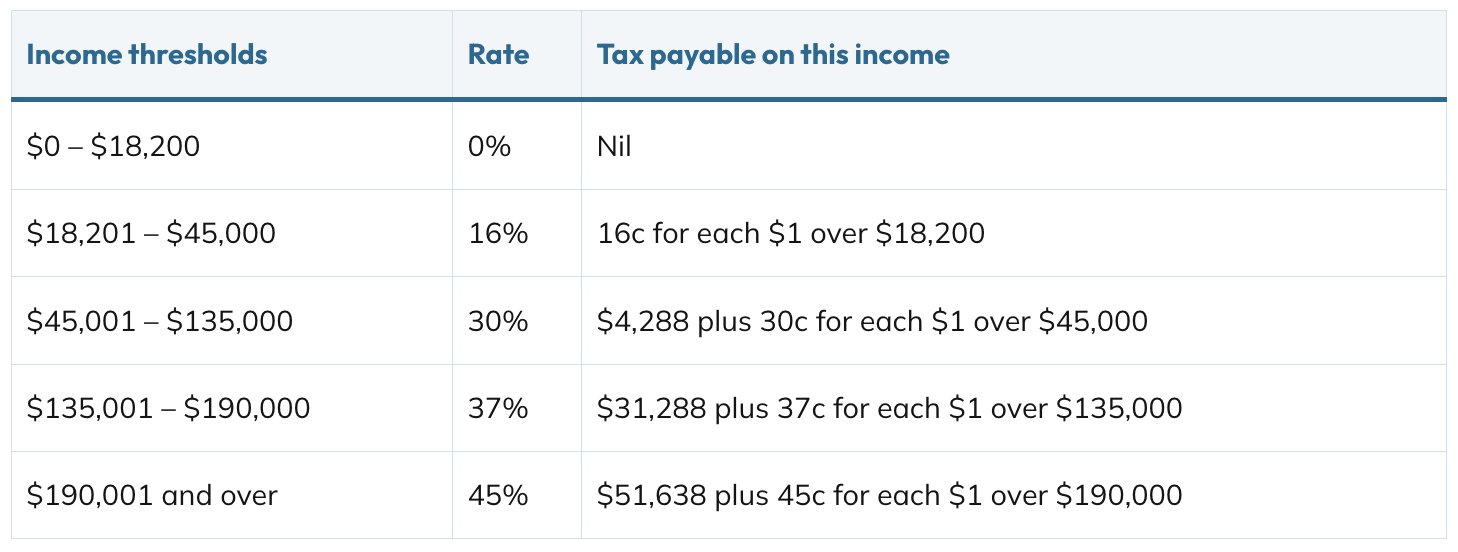

- Differing Tax Rates: Mining, staking, and other activities may have different capital gains or income tax rates.

- Multiple Income Sources: Income from freelancing, staking, or airdrops is taxed differently.

- Historical Price Data: Crypto must be reported at its fair market value on the transaction date. Reliable calculators provide this data.

- Record-Keeping Across Exchanges: A crypto tax calculator consolidates data from multiple wallets and exchanges, crucial for Australian tax reporting.

Key Features of Cryptocurrency Tax Calculators

- Tax Estimation: Calculate cryptocurrency tax australia on sales, trades, spending, rewards, and airdrops.

- Required Information: Enter cost basis, sale price, transaction dates, total income, and residency, or import CSVs and connect via API. This streamlined record-keeping supports compliance with Australian tax law.

- Automated Tax Classification: Determine if transactions create short-term or long-term capital gains, or ordinary income. Short-term holdings (<1 year) are generally taxed at higher rates, while crypto earned as payment is ordinary income.

- Automation & Integration: Bulk import historical trading data, automate cost-basis calculations, account for exchange fees, and set the correct tax year.

- Jurisdiction Support: Ensure the calculator supports Australian tax laws.

Popular Cryptocurrency Tax Calculators

Koinly

Koinly offers:

- Automated tax reporting across many exchanges and wallets

- Instant capital/income breakdown, including short- and long-term gains

- Prepopulated forms for Australian tax compliance

- Paid plans unlock more features; a free plan is available for basic calculations

CryptoTaxCalculator.io

CryptoTaxCalculator.io specializes in Australian tax reporting:

- Advanced support for various crypto activities including staking and forks

- Generates tax forms

- Tracks multi-chain and token movements

How to Use a Cryptocurrency Tax Calculator

-

Select your tax year – crucial, as tax rules change annually.

-

Enter transaction details – include transaction type, dates, amounts, prices, and platforms. For heavy users, import trading histories or use API connections.

-

Specify filing status and residency – ensures accurate calculation.

-

Review your tax liability – check breakdowns for capital gains, ordinary income, and total tax due. Early review helps with payment planning.

Limitations of Crypto Tax Calculators

- Most calculators provide estimates, not official tax advice.

- Complex activities may need manual review or accountant support.

- Regulations change frequently—ensure your tool is up-to-date.

- Software may have limitations; double-check with your tax professional.

Frequently Asked Questions

- What is the best cryptocurrency tax calculator for Australia?

Many Australian investors use Koinly or CryptoTaxCalculator.io for their ATO support, AUD pricing, and compliance features.

- Are crypto tax calculators accurate?

With complete data, major calculators are accurate for most situations. However, they may not handle all edge cases perfectly. For complex portfolios, consult a professional.

- Do I need to pay tax on every crypto transaction in Australia?

Every disposal event (selling, trading, gifting, or using crypto) can trigger capital gains tax. Earning crypto (from work, mining, or staking) may be taxed as income. Calculators help meet your cryptocurrency tax australia obligations.

- Is using a crypto tax tool enough, or do I still need an accountant?

Automated calculators are good for most DIY tax preparation. However, for large or complex portfolios, an accountant is recommended.

- Where can I learn more about crypto tax in Australia?

Consult the Australian Taxation Office (ATO) and TaxTracker for updates. Use calculators to stay compliant.

Important Disclaimer: The information provided in this content is for general informational purposes only and does not constitute legal, financial, or professional advice. Regulations and circumstances may vary based on your individual situation. You should always seek advice from a qualified professional, such as a registered tax agent, solicitor, or industry expert, before making any decisions or taking any action.