Understanding Superannuation Obligations for Employers: A Comprehensive Guide

Estimated reading time: 7 minutes

Key Takeaways

- Superannuation is a legal requirement for most Australian employees, designed to provide for their retirement.

- Employers must contribute a percentage of an employee’s earnings to their super fund.

- Recent changes include the increase to a 12% contribution rate by July 2025.

- Non-compliance can result in significant penalties and charges.

Table of contents

Superannuation is Australia’s mandatory retirement savings system designed to help workers build retirement funds through workplace contributions. Understanding your superannuation obligations for employers is essential for compliance and for supporting your employees’ financial well-being.

1. Overview of Superannuation in Australia

What is Superannuation?

Superannuation, commonly known as “super,” is Australia’s compulsory retirement savings system. It’s an essential part of the Australian financial landscape, enabling individuals to save for retirement.

The Role of Employer Contributions

Employer contributions are critical to the success of Australia’s superannuation system, helping employees accumulate savings for their retirement.

2. Understanding Superannuation Obligations for Employers

Employer Eligibility Requirements

As an employer in Australia, you are obligated to pay superannuation on behalf of almost all your workers. This includes:

- Full-time employees

- Part-time employees

- Casual employees

- Temporary residents

- Some contractors, if they’re deemed employees for super purposes

Superannuation Guarantee (SG) Contribution Rates

The Superannuation Guarantee (SG) rate is the minimum percentage of an employee’s ordinary time earnings that you must contribute to their super fund. The SG rate is set to increase to 12% by July 2025.

3. How to Calculate Employee Super

Step 1: Determine the Employee’s Ordinary Time Earnings (OTE)

To calculate super, start by identifying the employee’s OTE, which includes:

- Base salary for the ordinary hours of work

- Over-award payments

- Shift loadings

- Commission on sales

- Allowances (except for expense allowances)

- Paid leave (annual, sick, long service leave)

- Bonuses related to ordinary hours of work

4. How to Pay Super for Employees

Ensuring compliance in paying super for employees involves selecting an appropriate super fund and making timely contributions each quarter.

Frequently Asked Questions

What if I miss a super payment?

If you miss a payment, you may be liable for the Superannuation Guarantee Charge (SGC), which includes the unpaid super, interest, and an administrative fee. Immediate action is crucial to rectify the situation.

How are super payments taxed?

Super contributions are taxed at a concessional rate, which is generally lower than personal income tax rates. However, exceeding the contribution caps can incur additional taxes.

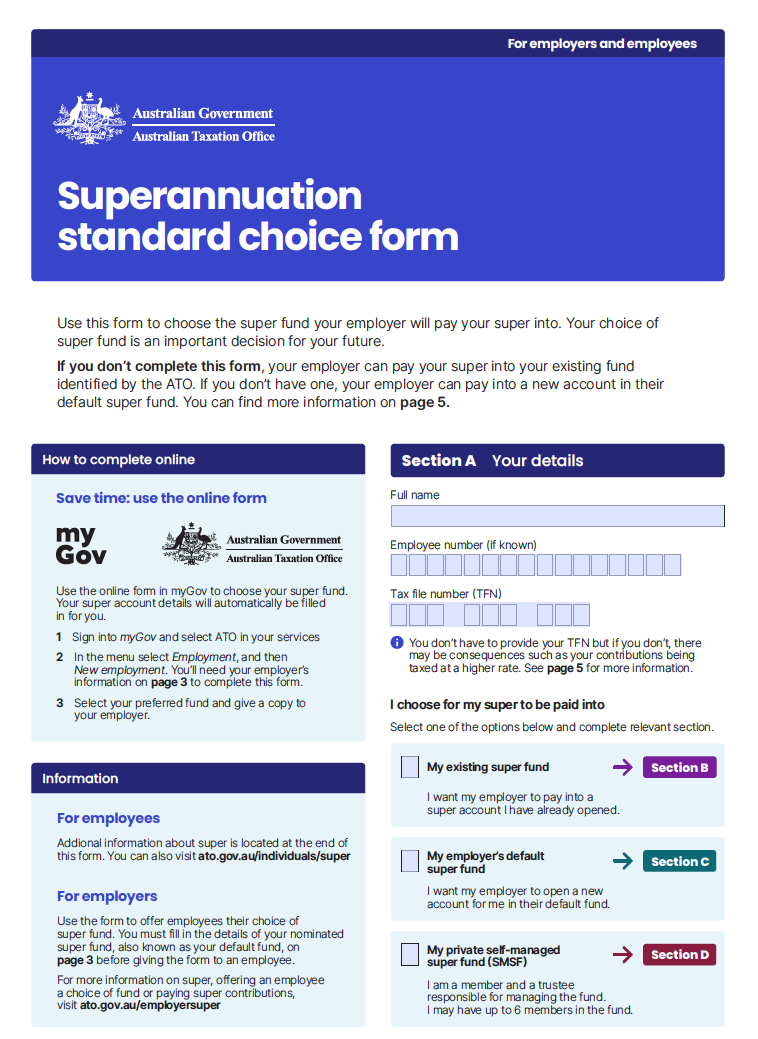

Can employees choose their super fund?

Most employees can choose their own super fund. It’s your responsibility as an employer to provide a standard choice form and contribute to the selected fund.

Important Disclaimer:

The information provided in this content is for general informational purposes only and does not constitute legal, financial, or professional advice. Regulations and circumstances may vary based on your individual situation. You should always seek advice from a qualified professional, such as a registered tax agent, solicitor, or industry expert, before making any decisions or taking any action.