What Happens If I Don’t Do My Tax Return in Australia?

Estimated Reading Time: 8 minutes

Key Takeaways

- The Australian Taxation Office (ATO) applies financial penalties and compounding interest for late or missing tax returns, regardless of whether you owe tax or are due a refund.

- Ongoing failure to lodge can result in enforced assessments, aggressive debt collection, negative credit impacts, and even legal action or prosecution in extreme cases.

- Missing your ATO tax return deadline can severely impact your ability to secure loans, claim refunds, or access government entitlements.

- Addressing overdue lodgements promptly and seeking professional help can minimise penalties and ensure your financial future is protected.

- Lodgement dates, penalty rates, and tax rules can change—always confirm official details on the ATO website before acting.

Table of Contents

- The Immediate Financial Consequences of Not Lodging

- ATO-Initiated Actions for Continued Non-Lodgement

- Long-Term Consequences for Your Financial Future

- When Non-Lodgement Becomes a Legal Matter

- How to Address Overdue Tax Returns

- FAQs

The Immediate Financial Consequences of Not Lodging

Missing your required income tax return or delaying your lodgement isn’t just risky—it can quickly become expensive. The Australian Tax Office (ATO) rigorously enforces deadlines to ensure your Australia tax return is filed on time. Here’s what happens if you miss your tax return deadline:

Failure to Lodge (FTL) Penalty

The ATO issues a Failure to Lodge (FTL) penalty when your tax return—or even required activity statements—are late.

Key points:

- Penalty Unit Value: For 2023-24, one penalty unit is $313. This rate can change, so check each year for updates.

- How It Accrues: One penalty unit is charged for every 28 days your ATO tax return remains overdue, up to five units maximum (i.e. $1,565 for individuals).

- Entity Scale: Medium and large entities face doubled or quintupled penalties—sometimes up to $7,825.

General Interest Charge (GIC)

If your lodged return results in a tax debt, the ATO applies daily, compounding interest—known as the General Interest Charge (GIC)—to unpaid amounts.

Key features:

- Interest compounds daily, increasing your debt rapidly.

- The GIC rate is adjusted quarterly; in mid-2024 it exceeded 11% annually.

- It’s separate from FTL penalties, and can exceed the original tax bill over time.

Example: If you owe $3,000 in unpaid tax and leave your return unlodged for over a year, you could face the maximum $1,565 FTL penalty plus compounding GIC, potentially growing your total liability above $5,000.

Shortfall Interest Charge (SIC)

If the ATO later amends your tax assessment (for example, after an audit reveals under-declared income), a Shortfall Interest Charge (SIC) applies at a lower rate, calculated from the original due date to the amended assessment date.

ATO-Initiated Actions for Continued Non-Lodgement

Ignoring reminders from myGov or the ATO increases the risk of enforcement actions. If you continue to avoid lodging your my tax return, the ATO can escalate its response in several serious ways.

Default Assessments

After repeated attempts to contact you, the ATO may issue a default assessment—an estimated tax bill compiled from third-party data (like employer income statements and bank interest). Default assessments rarely favour the taxpayer: deductions and offsets you might legitimately claim (such as work-related expenses) are excluded, often resulting in a larger tax liability than if you had submitted your own tax return in Australia.

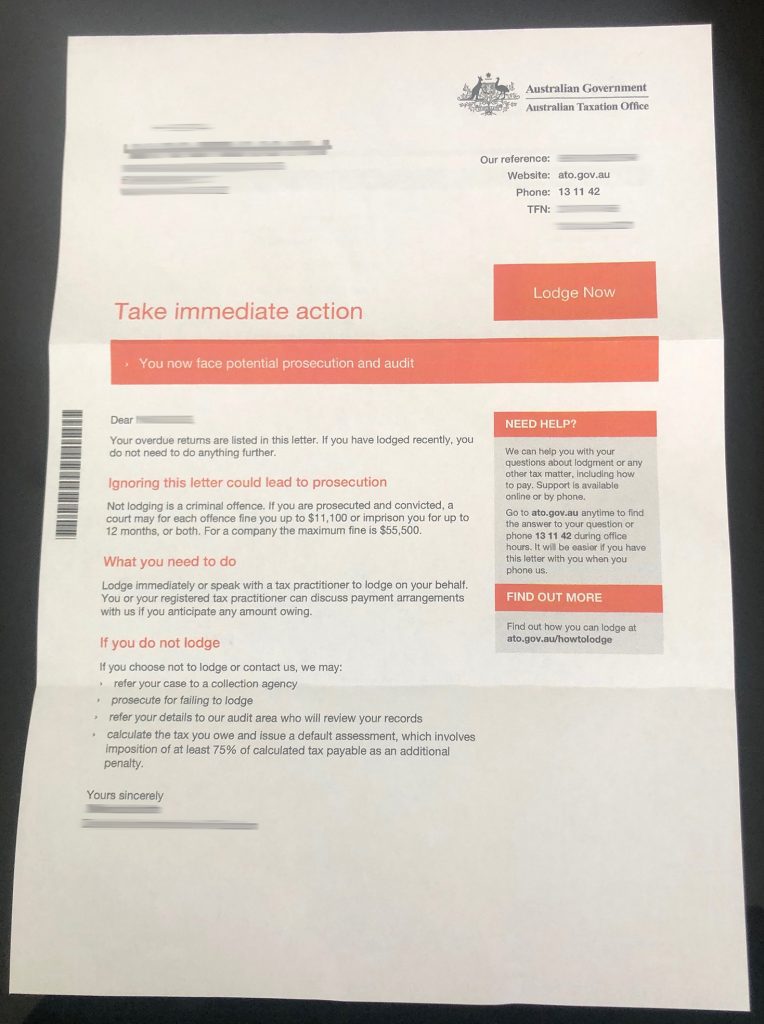

The Formal Notice Process

The ATO will typically send reminder letters and digital alerts via myGov, escalating to a formal “Notice to Lodge.” Non-compliance can trigger a final notice and, ultimately, a default assessment. Once issued, your right to dispute is significantly limited.

Debt Recovery and Enforcement Measures

If you fail to pay or respond, the ATO can:

- Garnishee Notices: Instruct your employer or bank to transfer money directly to the ATO.

- Disclose Tax Debts: Report large business tax debts to credit agencies, harming credit scores.

- Legal Action: Commence proceedings to recover debts, potentially resulting in charges over assets or bankruptcy via the Australian Financial Security Authority (AFSA).

Long-Term Consequences for Your Financial Future

Unlodged tax returns can produce ripple effects through your financial life—sometimes years later—regardless of whether you expect a refund or owe tax. Here’s why compliance matters for your future:

Risk of Forfeiting Tax Refunds

If you miss a tax deadline, you might actually lose out on money owed to you. There are strict time limits on claiming refunds—generally two years from your notice of assessment for individuals and small businesses. Persistent non-lodgement may mean forfeiting refunds altogether, or missing opportunities to correct mistakes via amendment.

Impact on Credit and Loan Applications

Financial institutions require recent tax returns (and notices of assessment) for loan applications. Missing or overdue tax return dates mean:

- Mortgages and Car Loans: Banks will typically refuse to lend without up-to-date income evidence.

- Business Financing: Unlodged returns can block funding for startups or expansion.

- Even rental and lease applications may be rejected without tax documentation.

Eligibility for Government Benefits and Programs

Your lodged tax information affects eligibility for Centrelink payments, the Family Tax Benefit, and other government programs. Missing returns can delay or prevent access to essential support.

When Non-Lodgement Becomes a Legal Matter

Although most missing or overdue tax returns are handled administratively, long-term or deliberate non-compliance can escalate to criminal prosecution.

Potential for Prosecution

While rare, the ATO will pursue criminal charges if they suspect systematic evasion or ignoring repeated warnings, particularly when large sums or deliberate deception are involved. Prosecuted individuals face significant fines and—at the extreme end—imprisonment. The Commonwealth Director of Public Prosecutions (CDPP) manages these cases.

How to Address Overdue Tax Returns

Overdue or missing tax returns are daunting, but manageable. Here’s a practical step-by-step approach to getting back on track:

1. Lodge All Outstanding Returns Voluntarily

Preparing and submitting all overdue ATO tax returns quickly is the best way to demonstrate good faith and minimise further penalties. The ATO is more likely to remit fines if you lodge before enforcement begins, especially if you can show valid reasons for the delay.

2. Assess Your Financial Position

Once your 2025 tax return and previous outstanding returns are lodged, review your actual tax liabilities or refunds—and the effect of any imposed penalties or GIC amounts.

3. Communicate with the ATO

If you can’t pay immediately, don’t ignore the issue; contact the ATO directly (via myGov or phone) or ask a registered tax agent for help. The ATO frequently arranges manageable payment plans to help you meet your obligations over time.

4. Seek Professional Assistance

A qualified tax agent or accountant can:

- Prepare overdue returns accurately to maximise deductions.

- Negotiate penalty remission or payment plans with the ATO.

- Communicate with the taxation office and manage ongoing compliance on your behalf.

Choosing an experienced professional can significantly reduce stress and ensure your tax situation is resolved faster—helping you avoid future issues with your tax return in Australia.

FAQs

Important Disclaimer:

The information provided on this website is general in nature and is based on guidance published by the Australian Taxation Office (ATO) at the date of writing. It does not consider your personal or business circumstances and should not be relied upon as tax advice. Reading this content does not create a tax agent–client relationship.

While every effort is made to ensure accuracy, no guarantee is given that the information is complete, up to date, or free from error. Lodgment dates and tax rules may change without notice. You should obtain professional advice before acting on any information provided on this website.

Tax Tracker Pty Ltd and its representatives accept no liability for any loss arising from reliance on the information provided. For personalised tax advice, please contact our office to formally engage our services.