What Is Double Entry Bookkeeping – The Foundation of Modern Accounting

Estimated reading time: 9 minutes

Key Takeaways

- Double entry bookkeeping is the cornerstone of accounting and bookkeeping worldwide, ensuring that every transaction is accurately tracked in at least two accounts.

- The system supports business bookkeeping for companies of every size, from small business startups to global enterprises.

- Following the dual recording rule keeps the accounting equation balanced and greatly improves accuracy and error detection.

- With a clear understanding and the right bookkeeping service or software, even small business owners can master double entry and remain compliant in Australia and worldwide.

Table of contents

- What Is Double Entry Bookkeeping – The Foundation of Modern Accounting

- Key Takeaways

- The Backbone of Financial Record-Keeping

- Key Principles of Double Entry Bookkeeping

- How Double Entry Bookkeeping Works in Practice

- The Five Types of Accounts in Double Entry Bookkeeping

- The Essential Rules of Double Entry Bookkeeping

- The Critical Importance of Double Entry Bookkeeping

- Double Entry vs. Single Entry Bookkeeping

- Frequently Asked Questions

The Backbone of Financial Record-Keeping

Have you ever wondered how corporations keep their financial records straight? Or why accountants talk about “balancing the books”? The answer lies in double entry bookkeeping—a system so reliable it has stood the test of time since the Renaissance.

This system forms the core of accounting and bookkeeping for businesses everywhere. Unlike single entry systems, double entry bookkeeping provides a complete and accurate picture of every financial transaction.

For small business bookkeeping, understanding double entry is key. Maintaining accurate and informative financial records is essential for compliance and business growth in Australia.

Key Principles of Double Entry Bookkeeping

- Dual Recording: Every transaction is entered twice—once as a debit and once as a credit. This reflects the reality that every movement of money affects two parts of the business. “The dual recording principle ensures that every financial action has an equal and opposite reaction in your books.”

- Balance Assurance: The sum of all debits must always equal the sum of all credits. This balance acts as an inherent accuracy check, making it easier to spot errors or fraud. “This balance requirement acts as a continuous audit of your books, immediately highlighting when something doesn’t add up.”

- Accounting Equation Integrity: The system maintains Assets = Liabilities + Equity at all times. This ensures the true financial position of the business is always reflected. “The accounting equation is like financial gravity—it cannot be violated, and double entry bookkeeping ensures it stays in balance with every transaction.”

How Double Entry Bookkeeping Works in Practice

Every transaction is recorded twice, impacting at least two accounts—one debit and one credit. This keeps everything balanced and crystal clear in online bookkeeping software or manual ledgers.

Example 1: Purchasing Equipment on Credit

If a bakery purchases a $3,500 mixer on credit:

- Equipment (asset) account is debited $3,500 (increased)

- Accounts Payable (liability) account is credited $3,500 (increased)

This increases both assets and liabilities, keeping Assets = Liabilities + Equity in balance. This also affects tax timing and deductions, linked with rules such as the Instant Asset Write-Off.

Example 2: Owner Investment

When an owner invests $25,000:

- Cash (asset) account is debited $25,000 (increased)

- Owner’s Equity (liability) account is credited $25,000 (increased)

This maintains the balance and provides a transparent trail for accountants and tax professionals, supporting bookkeeping education and career development.

The Five Types of Accounts in Double Entry Bookkeeping

-

- Asset Accounts – What the business owns: cash, inventory, equipment. Usually have debit balances (increase when debited).

-

- Liability Accounts – What the business owes: loans, accounts payable, mortgages. Usually have credit balances (increase when credited).

-

- Equity Accounts – The owner’s stake: owner’s capital, retained earnings. Crucial for reporting and compliance.

-

- Revenue (Income) Accounts – Earnings from sales/services; always credited. Essential for understanding business success.

- Expense Accounts – Business costs: rent, payroll, utilities. Debited when increased. These five account types are foundational for visualising the full financial picture.

The Essential Rules of Double Entry Bookkeeping

-

- Record Each Transaction Twice: Every transaction must hit at least two accounts—one as a debit, one as a credit. This “double effect” is the essence of modern financial accounting.

-

- Total Debits = Total Credits: For each transaction, the total debits must precisely match total credits. Imbalances flag errors, protecting integrity and transparency.

- The Ledger Must Remain Balanced: The books must always balance. Any discrepancy instantly signals a misguided entry or missing record.

The Critical Importance of Double Entry Bookkeeping

-

- Accuracy and Error Detection: Double entry bookkeeping makes it immediately obvious if a mistyped or misapplied entry has occurred—errors reveal themselves as soon as the books stop balancing. This is vital for annual close and ongoing compliance.

-

- Comprehensive Financial Insight: The method provides robust clarity, showing exactly how money moves through a business.

-

- Regulatory Compliance: Both public and private companies must comply with global accounting standards, which require double entry bookkeeping. This also links to broader employer obligations such as superannuation, payroll tax, and reporting.

- Better Decision-Making: Double entry enables reliable statements for management, loans, and investors—the data is richer, supporting real strategic decisions, and aligned with the growth of bookkeeping in Australia.

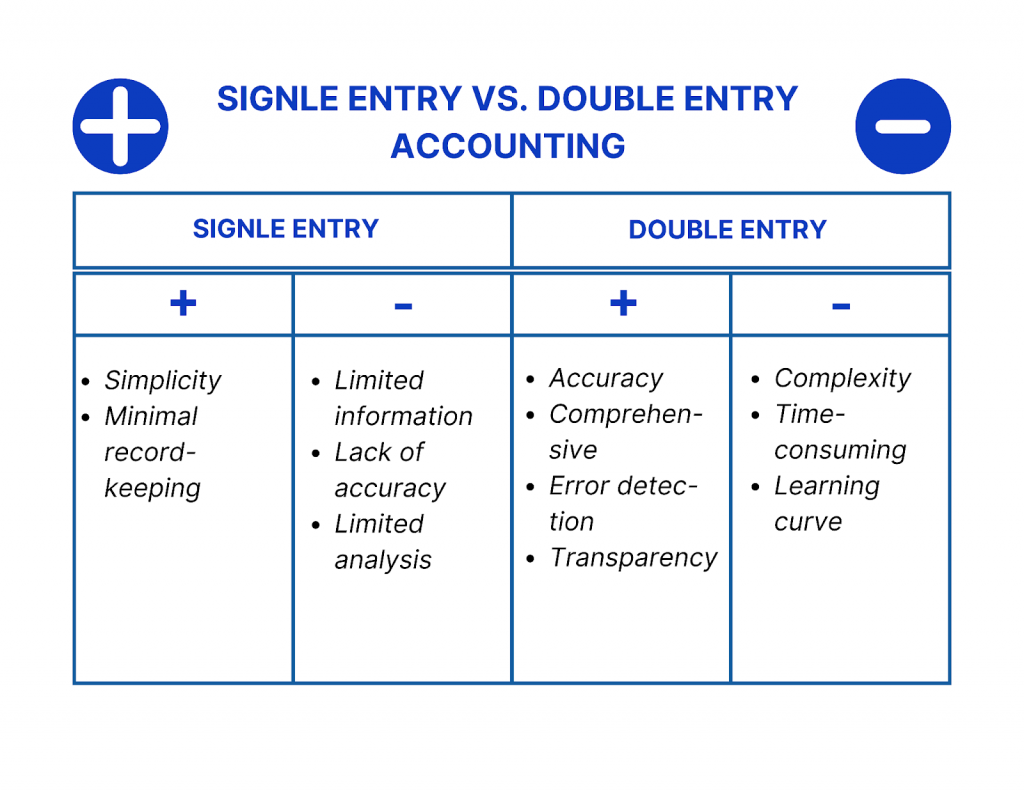

Double Entry vs. Single Entry Bookkeeping

| Feature | Single Entry | Double Entry |

|---|---|---|

| Accounts affected per entry | One | At least two |

| Balancing requirement | No | Yes (debits = credits) |

| Error detection | Limited | Built-in |

| Complexity | Simpler | More robust |

| Financial reporting support | Limited | Full (income statement, balance sheet, etc.) |

Single entry bookkeeping may appeal for its simplicity in household or very basic business settings, but double entry is the only system that allows true compliance, insightful analysis, and future planning. Modern bookkeeping software makes double entry accessible to every business owner.

Frequently Asked Questions

- What types of businesses should use double entry bookkeeping?

All small and medium businesses seeking financial accuracy, transparency, and compliance should adopt double entry. It’s required for companies, but even sole traders can benefit from the clarity provided. - Can I do double entry bookkeeping myself, or do I need a professional?

With a suitable online bookkeeping platform or after some education, business owners can manage the basics themselves. For complex situations, engaging a professional is wise. - Is double entry bookkeeping difficult to learn?

The concepts are straightforward with the right training. Many accessible resources make learning achievable even for beginners. - What software helps with double entry bookkeeping?

Various accounting software solutions excel at handling double entry transactions, making business bookkeeping much simpler.

Important Disclaimer: The information provided in this content is for general informational purposes only and does not constitute legal, financial, or professional advice. Regulations and circumstances may vary based on your individual situation. You should always seek advice from a qualified professional, such as a registered tax agent, solicitor, or industry expert, before making any decisions or taking any action.