Australian Tax Return Deadline: Everything You Need to Know for 2024-25

Estimated reading time: 10 minutes

Key Takeaways

- The Australian financial year runs from 1 July to 30 June, affecting your tax return timeline.

- The standard deadline to lodge your tax return is 31 October 2025.

- Engaging a registered tax agent can extend your lodgement deadline to 15 May 2026.

- Missing the deadline can result in penalties, interest charges, and potential audits.

- Proper planning and organization are essential to meet the ATO deadlines.

Table of Contents

- Understanding the Australian Financial Year and Tax Return Timeline

- The 31 October Deadline: What It Means for Self-Lodgers

- Extensions Through Registered Tax Agents: How They Work

- Consequences of Missing the Australian Tax Return Deadline

- Business Owners and Additional Tax Deadlines

- Planning Ahead: Tips for Meeting the Australian Tax Return Deadline

- Special Circumstances and Deadline Extensions

- Frequently Asked Questions

The Australian tax return deadline is a date that looms large for millions of taxpayers each year. With the 2024-25 financial year underway, understanding when your tax return is due and what happens if you miss this crucial deadline has never been more important. The Australian tax return deadline for individuals lodging their own return for the 2024–25 financial year is 31 October 2025. This date marks the culmination of the tax season and represents a critical deadline that all self-lodging taxpayers must meet to avoid potential penalties.

Whether you’re a seasoned taxpayer or filing for the first time, navigating the Australian tax system can be complex. This comprehensive guide will walk you through everything you need to know about tax return deadlines in Australia, including key dates, extension possibilities, and the potential consequences of missing the deadline.

Understanding the Australian Financial Year and Tax Return Timeline

The Australian financial year doesn’t follow the calendar year, which can sometimes cause confusion for taxpayers. Instead, it runs from 1 July to 30 June of the following year. This means the 2024-25 financial year spans from 1 July 2024 to 30 June 2025.

Understanding this timeline is crucial because it determines the period for which you’ll be reporting income and expenses on your income tax return. After the financial year ends on 30 June 2025, you’ll have a four-month window to prepare and submit your tax return myGov, with the lodgement period opening on 1 July 2025 and closing on 31 October 2025.

This four-month period gives taxpayers time to:

- Gather all necessary documentation

- Calculate deductions and offsets

- Complete the tax return form

- Submit it to the Australian Taxation Office (ATO)

However, four months can pass quickly, especially if you’re waiting for important documents or dealing with complex tax situations. That’s why it’s advisable to start preparing well before the deadline approaches.

The 31 October Deadline: What It Means for Self-Lodgers

If you’re handling your own tax return through myGov, the ATO app, or a paper form, the 31 October 2025 deadline applies directly to you. This is the date by which the ATO must receive your completed tax return to consider it on time.

It’s worth noting that the 31 October deadline falls on a Friday in 2025. If you’re planning to lodge right at the deadline, remember that technical issues, high traffic on the ATO website, or postal delays could potentially cause you to miss this cutoff date. To avoid last-minute stress, tax experts typically recommend filing your tax return at least a few weeks before the deadline.

The 31 October deadline applies regardless of:

- Whether you’re expecting a refund or have tax to pay

- How complex your tax affairs are

- Whether you’ve lodged before or are a first-time lodger

The only exception to this deadline is if you engage a registered tax agent, which we’ll explore in more detail below.

Extensions Through Registered Tax Agents: How They Work

One of the significant advantages of using a registered tax agent is the possibility of an extended lodgement deadline. If you engage a tax agent before 31 October 2025, you may qualify for an extension that pushes your lodgement deadline back to 15 May 2026.

This nearly seven-month extension can be invaluable for those with complex tax situations or those who simply need more time to organize their tax affairs. However, there are important conditions to be aware of:

- You must engage the tax agent before the standard 31 October deadline

- You generally cannot qualify for this extension if you have outstanding or overdue tax returns from previous years

- The tax agent must be registered with the Tax Practitioners Board [source]

To take advantage of this extension, you’ll need to:

- Research and select a registered tax agent

- Make contact and engage their services

- Provide them with your tax file number and authorization to act on your behalf

- Supply all necessary documentation for your tax return

It’s worth noting that while the extension gives you more time to lodge your tax return, it doesn’t necessarily extend any payment due dates for tax liabilities. If you expect to owe tax, discuss payment timing with your tax agent.

Consequences of Missing the Australian Tax Return Deadline

The ATO takes lodgement deadlines seriously, and missing the due date without proper arrangements can lead to significant consequences.

If you fail to lodge your tax return by 31 October 2025 (or the extended deadline if using a tax agent), you may face:

- Failure to Lodge (FTL) penalties: These can accumulate at a rate of $222 for each 28-day period that your return is overdue, up to a maximum of $1,110 for individuals

- General Interest Charges (GIC): If you owe tax and don’t pay by the due date, interest charges will apply to the outstanding amount [source]

- Potential audit flags: Late lodgements may increase your chances of being selected for an ATO audit

- Delays in receiving refunds: If you’re entitled to a refund, you won’t receive it until you lodge your return

It’s important to note that if you don’t need to lodge a tax return (perhaps because your income was below the tax-free threshold), you should still submit a Non-Lodgement Advice to the ATO to avoid compliance action. This simple process informs the ATO that you’re aware of your obligations but aren’t required to lodge for the specific financial year [source].

Business Owners and Additional Tax Deadlines

If you’re a business owner, the 31 October deadline still applies for your business tax return (for entities with a 30 June balance date). However, like individuals, businesses using registered tax agents may qualify for an extension, typically to 15 May of the following year.

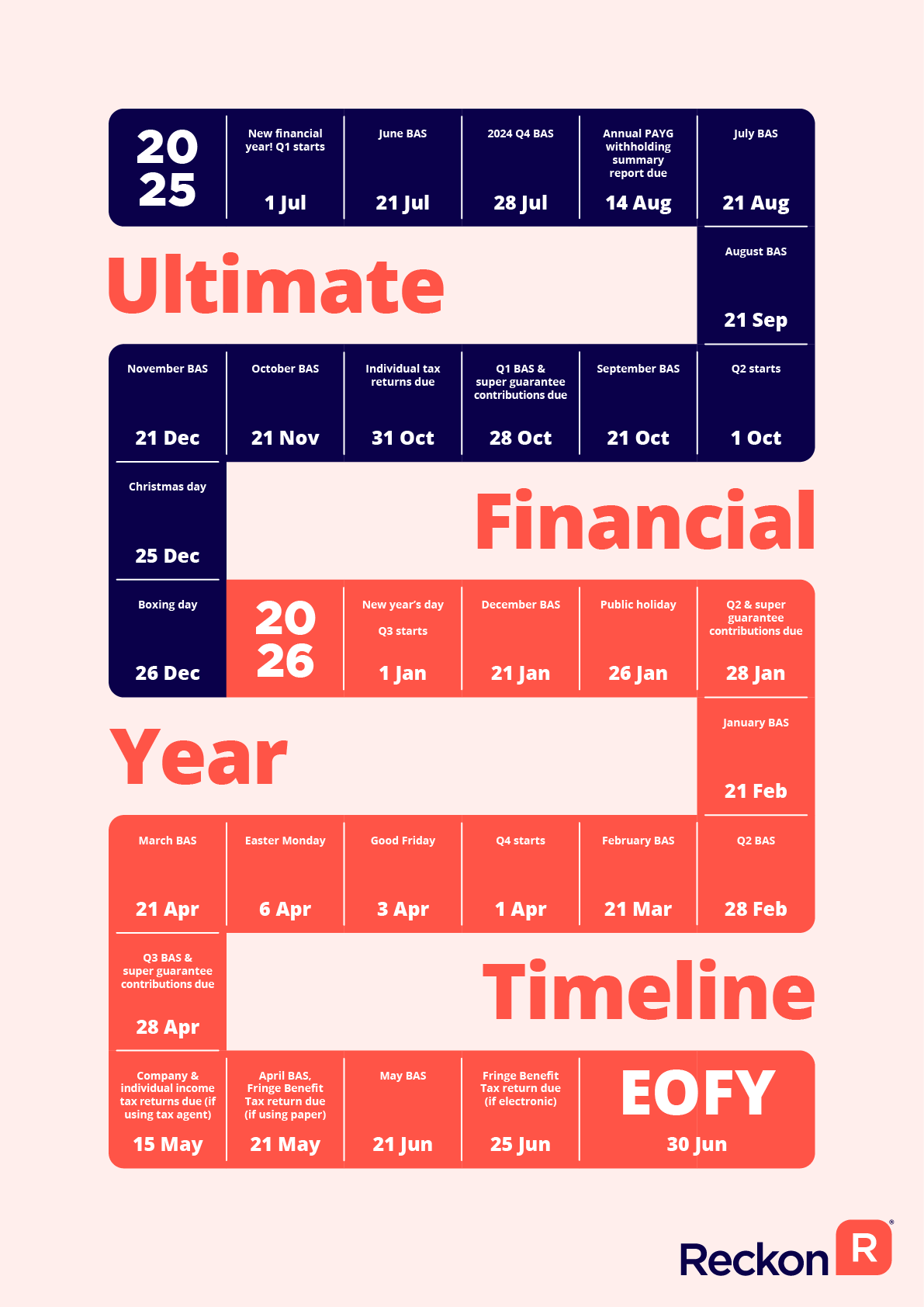

Beyond the annual tax return, business owners need to be aware of several other important tax deadlines throughout the year:

- Goods and Services Tax (GST) activity statements: These may be due monthly or quarterly, depending on your business size and reporting cycle [source]

- Fringe Benefits Tax (FBT): Usually due by 21 May each year [source]

- Pay-As-You-Go (PAYG) withholding: Generally due monthly or quarterly, typically on the 21st or 28th of the relevant month

These additional obligations make tax planning and compliance even more complex for business owners, highlighting the potential value of engaging a professional tax agent to help manage these various deadlines.

Planning Ahead: Tips for Meeting the Australian Tax Return Deadline

To ensure you meet the Australian tax return deadline and minimize stress during tax season, consider these practical tips:

- Maintain organized records throughout the year: Keep receipts, payment summaries, and other tax-related documents in a dedicated location

- Set calendar reminders: Mark the 31 October 2025 deadline in your calendar, along with an earlier date to start preparing your tax return

- Consider using a registered tax agent: If your tax affairs are complex or you anticipate needing more time, engage a tax agent well before 31 October.

- Use the ATO’s online services: The myGov portal and ATO app can streamline the lodgement process and give you immediate confirmation when your return is received

- Check for pre-filled information: The ATO often pre-fills information from employers, banks, and other institutions, which can simplify the lodgement process

- Lodge early if expecting a refund: If you anticipate receiving a tax refund, lodging early means you’ll likely receive your money sooner

Remember that the ATO typically processes most returns within two weeks, so lodging well before the deadline can help ensure your tax refund is processed promptly and any refund is paid without unnecessary delays.

Special Circumstances and Deadline Extensions

While the 31 October deadline is relatively strict, the ATO may grant extensions in certain special circumstances:

- Natural disasters: If you’ve been affected by a recognized natural disaster, the ATO may automatically defer lodgement deadlines

- Serious illness or family crisis: You may be granted an extension if you or a close family member experiences a serious illness or crisis that impacts your ability to lodge on time

- Technical issues with ATO systems: If ATO online systems experience significant outages [source]

Frequently Asked Questions

When is the tax return deadline for the 2024-25 financial year?

The deadline to lodge your tax return for the 2024-25 financial year is 31 October 2025.

How can I extend my tax return deadline?

Engaging a registered tax agent before the 31 October deadline can extend your lodgement deadline to 15 May 2026.

What happens if I miss the tax return deadline?

Missing the deadline can result in Failure to Lodge penalties, General Interest Charges, potential audits, and delays in receiving refunds.

Do I need to lodge a tax return if my income is below the tax-free threshold?

Yes, you should submit a Non-Lodgement Advice to inform the ATO that you’re not required to lodge a return for the specific financial year.

Can I lodge my tax return online?

Yes, you can lodge your tax return australia online through the myGov portal or the ATO app.

Important Disclaimer:

The information provided in this content is for general informational purposes only and does not constitute legal, financial, or professional advice. Regulations and circumstances may vary based on your individual situation. You should always seek advice from a qualified professional, such as a registered tax agent, solicitor, or industry expert, before making any decisions or taking any action.