How Business Tax Impacts Small Businesses: A Comprehensive Guide

Estimated reading time: 8 minutes

Key Takeaways

- Business tax is crucial for compliance and financial planning.

- There are various types of taxes applicable, such as income tax and GST.

- Understanding tax rates and deductions can significantly impact profitability.

- Provisions like instant asset write-offs provide financial advantages.

Table of Contents

Business tax refers to the compulsory financial charges imposed on businesses by Australian government authorities. These taxes are unavoidable when running a company, yet many small business owners struggle with the complexities involved. Understanding business tax is vital not only for compliance but also for effective financial planning and maximizing profitability.

Understanding Business Tax

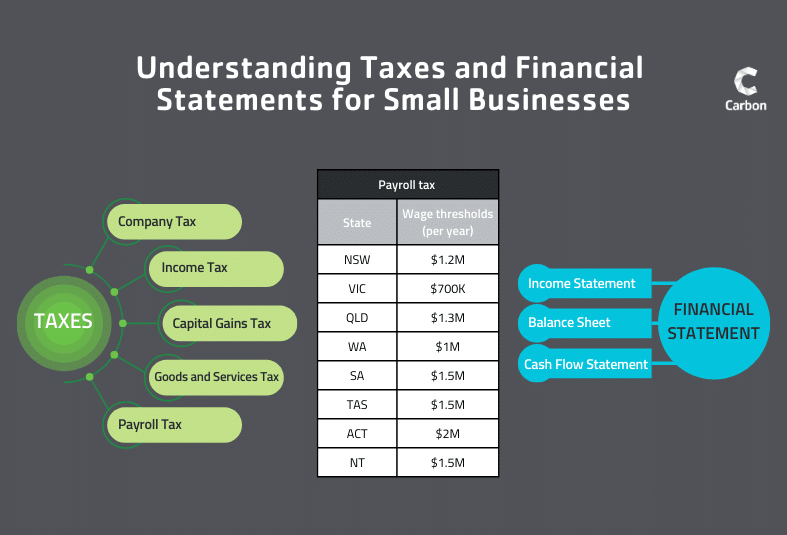

Australian business tax includes all taxes a business entity must pay throughout its operational lifespan. This goes beyond annual payments and includes income tax, payroll tax, Goods and Services Tax (GST), and other levies depending on location, industry, and business structure.

Income Tax

Income tax is levied on your business’s profits. For small businesses, this is calculated using your taxable income – total revenue less allowable business expenses. The tax calculation depends on your business structure (sole trader, partnership, or company).

Company Tax

Company tax applies specifically to the profits of incorporated businesses. The company tax rate in Australia varies depending on factors like business size and annual revenue. For small businesses structured as companies, understanding this rate is crucial for accurate financial forecasting.

Goods and Services Tax (GST)

GST is a consumption tax on most goods and services sold in Australia. As a business, you collect this tax from customers and remit it to the Australian Taxation Office (ATO), acting as an intermediary. While not directly a tax on profits, GST compliance needs meticulous record-keeping and regular reporting. Source

Payroll Tax

Payroll tax is levied on wages paid to employees. The rate and threshold vary by state or territory, typically becoming applicable once payroll exceeds a specific amount. This is a significant consideration for growing small businesses.

Small businesses should carefully consider the company tax rate, potential deductions, and provisions like instant asset write-offs. These factors heavily influence your effective tax rate and overall financial health. Source

The Company Tax Rate

The company tax rate is the percentage of a company’s taxable income paid in tax. This directly impacts the amount of profit retained for reinvestment. Understanding this rate is crucial for financial projections and strategic decision-making.

- Reduced Capital for Growth: Higher taxes reduce retained profits, limiting funds for expansion, R&D, or market entry.

- Hiring Constraints: Higher tax burdens may delay or prevent hiring, impacting productivity and growth.

- Limited Reinvestment: Investment in equipment, technology, or facilities may be postponed due to higher tax payments.

- Cash Flow Pressure: High tax rates can strain cash flow, especially for businesses with seasonal variations or tight margins.

Conversely, lower company tax rates offer benefits:

- Improved Profitability: Lower tax rates increase after-tax profits, strengthening the financial position.

- Increased Investment Capacity: More retained earnings allow for greater investment in growth.

- Enhanced Employment Opportunities: Increased funds may enable hiring and training, boosting business and community growth.

- Better Cash Flow Management: Lower tax obligations ease cash flow pressures, enabling better financial planning.

Understanding how changes to the company tax rate affect your business is crucial for adapting your financial strategy. Proactive small business owners monitor current rates and proposed changes in tax policy. Source

Instant Asset Write-Off

The instant asset write-off is a tax incentive supporting small businesses and encouraging investment. Eligible small businesses can immediately deduct the full cost of qualifying assets (up to a certain threshold) in the year of purchase, rather than depreciating them over time.

When a small business buys an eligible asset (like vehicles, tools, or machinery), it can claim the entire cost as a tax deduction if the cost is below the current threshold. Source

For example, a small manufacturer buying $18,000 equipment can deduct the full amount immediately, reducing its tax liability and freeing up cash.

- Accelerated Tax Relief: Businesses receive the full tax benefit upfront.

- Simplified Accounting: Depreciation calculations are eliminated, simplifying bookkeeping.

- Incentivized Modernization: The provision encourages equipment and technology upgrades, improving efficiency.

- Strategic Timing Opportunities: Businesses can time purchases to maximise tax benefits in high-income years.

The instant asset write-off threshold and eligibility criteria can change. Small business owners should stay informed about current provisions and consult tax professionals before major purchases. Source

Impacts of Business Taxes on Small Businesses

Business taxes, especially the company tax rate and instant asset write-off, significantly impact small businesses. These tax elements shape their financial landscape, influencing decisions from daily operations to long-term strategic planning.