How to Lodge BAS: A Complete Guide to BAS Reporting Obligations

Estimated reading time: 10 minutes

Key Takeaways

- How to lodge BAS is essential for GST-registered businesses in Australia.

- BAS is critical for reporting taxes like GST, PAYG, to the ATO.

- Accurate BAS lodgment avoids fines and keeps businesses compliant.

- This guide helps you understand BAS and its components.

Table of contents

What is a BAS Statement?

What is BAS statement

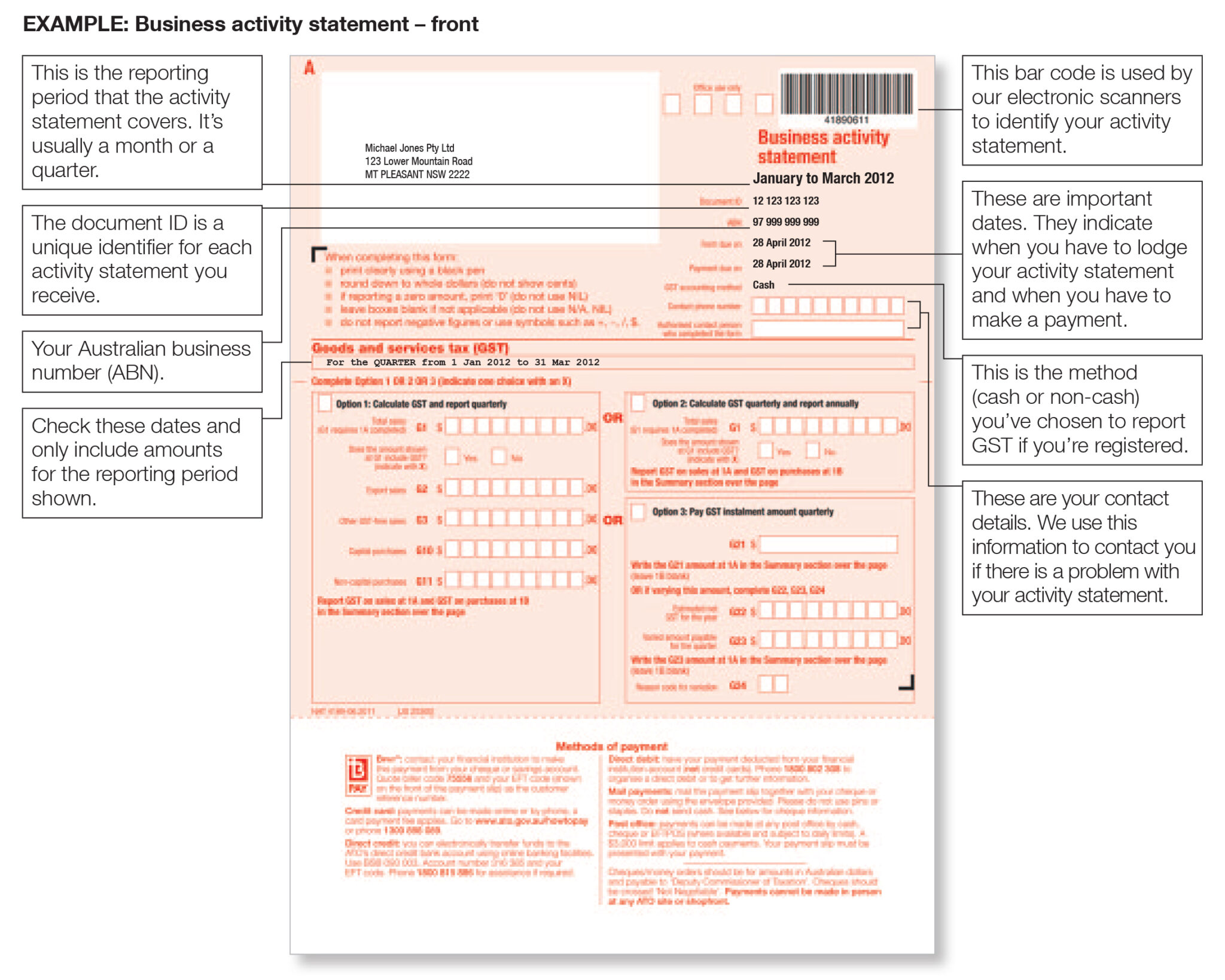

A Business Activity Statement (BAS) is a form that the ATO sends to businesses so they can report and pay the taxes they owe. If your business is registered for an ABN and GST, you’ll receive a BAS when it’s time to lodge.

What Does a BAS Report?

- Goods and Services Tax (GST)

- Pay As You Go (PAYG) instalments

- PAYG withholding tax

- Fringe Benefits Tax (FBT)

- Luxury Car Tax (LCT)

- Wine Equalisation Tax (WET)

This makes BAS a one-stop form for managing your business taxes.

Components of a BAS

Your BAS includes boxes to fill in amounts for:

- Total sales (G1)

- Export sales (G2)

- GST-free sales (G3)

- GST on sales (1A)

- GST on purchases (1B)

- PAYG instalments and withholding

Each section represents a different obligation.

Why BAS is Important

- Keeps your tax reporting up-to-date

- Avoids penalties

- Helps you manage cash flow

- Ensures your business stays compliant

Do I Need to Lodge BAS?

Do I need to lodge BAS

Not sure if you must submit a BAS? Here’s how to know.

Who Must Lodge

- You are registered for GST

- Your annual turnover is $75,000 or more, or

- You’re a non-profit organization earning $150,000 or more

If you register for GST voluntarily, you’ll also need to lodge BAS.

The ATO automatically adds you to the BAS system once you have a GST-registered ABN.

Other Reasons You May Need to Lodge

- Withhold tax from employee wages (PAYG withholding)

- Pay PAYG income tax instalments

Even if your business isn’t registered for GST, you may need to lodge BAS for other tax obligations.

Special Cases

If you’re not required to register for GST, you generally don’t need to lodge a BAS – unless you opted in for other reporting requirements.

Always check your business registration and tax responsibilities.

BAS Reporting Obligations

BAS reporting obligations

Lodging your BAS on time is a legal responsibility. Here’s what that means.

What the Law Requires

- You must lodge BAS by the due date

- You must pay any amounts due

- You must keep records for at least five years

Failure to follow these rules can result in serious consequences.

https://www.ato.gov.au/business/record-keeping-for-business/

What Happens If You Don’t Lodge BAS

- Failure to Lodge (FTL) penalties apply based on how late you are.

- You’ll be charged **General Interest Charges (GIC)** on tax debts.

- Repeated non-compliance affects your reputation with the ATO.

- You may lose access to payment plans or tax concessions.

Stay Compliant

- Keep accurate records

- Reconcile your books monthly

- Lodge BAS early or on time

For insights on avoiding common mistakes, refer to https://taxtracker.com.au/common-bas-mistakes-guide/.

GST Reporting for Small Businesses

GST reporting for small businesses

Smaller businesses still have big responsibilities when it comes to GST. Here’s how to handle it with care.

What Is GST?

- GST is a 10% tax on most goods and services sold in Australia.

- You collect GST on your sales (outputs).

- You claim GST paid on your purchases (inputs).

You then report this on your BAS form.

BAS Sections Related to GST

- G1: Total sales

- G2: Export sales

- G3: Other GST-free sales

- G10: Capital purchases

- G11: Non-capital purchases

- 1A: GST collected on sales

- 1B: GST credits on purchases

Tips to Report GST Accurately

- Keep receipts and invoices

- Use accounting software like Xero or SleekBooks

- Reconcile accounts monthly

- Double-check GST-inclusive vs GST-exclusive figures

Accurate GST reporting for small businesses ensures you don’t pay more than you owe and keeps your ATO record clean.

Explore more on maximizing your tax claims at https://taxtracker.com.au/small-business-tax-deductions-australia.

How to Lodge BAS: Step-by-Step Guide

How to lodge BAS

You can lodge BAS in three main ways. Let’s go step-by-step.

Method 1: Online Lodgment (Recommended)

Source: Sleek – How to lodge BAS

Benefits of Online Lodgment:

- Instant confirmation

- Extra time to lodge

- Faster refunds

- Fewer errors

How to Lodge Online:

- Sole Traders:

- Log in to myGov

- Link your ABN

- Access ATO Online Services

- Businesses:

- Set up myGovID

- Link ABN using Relationship Authorisation Manager (RAM)

- Use Online Services for Business

- Using Accounting Software:

- Tools like Xero or SleekBooks handle BAS preparation and filing.

- Lodging through software saves time and avoids mistakes.

Method 2: Use a Registered BAS or Tax Agent

- Agents can:

- Prepare and lodge on your behalf

- Give professional advice

- Help with complex tax issues

- Offer extended deadlines

Ideal if your BAS is complicated or time is limited.

Learn why hiring a professional is beneficial at https://taxtracker.com.au/registered-tax-agent-small-business.

Source: Sleek – How to lodge BAS

Method 3: Paper Form (Not Recommended)

You can complete the paper BAS form sent by the ATO.

- Steps:

- Fill out the form manually

- Sign and date it

- Send it by mail to the ATO

Note: Paper lodgment has shorter deadlines and slower processing.

What You’ll Need to Lodge

- Sales records

- Receipts for business expenses

- Payroll summaries

- Previous BAS forms (for reference)

- Bank reconciliation statements

Common Lodgment Mistakes

- Confusing GST-inclusive & exclusive figures

- Entering numbers in the wrong GST labels (like 1A/1B)

- Missing the signature (paper lodgment)

- Lodging or paying late

Avoid these to file correctly the first time.

Source: Sleek – How to lodge BAS

BAS Due Dates 2025

Keyword: BAS due dates 2025

Mark these deadlines in your calendar to stay on top of BAS lodgments in 2025.

Quarterly BAS Due Dates

| Quarter | Period | Paper Lodgment Due | Online Lodgment Due |

|---|---|---|---|

| Q1 | Jul–Sep 2025 | 28 Oct 2025 | 11 Nov 2025 |

| Q2 | Oct–Dec 2025 | 28 Feb 2026 | 28 Feb 2026 |

| Q3 | Jan–Mar 2025 | 28 Apr 2025 | 12 May 2025 |

| Q4 | Apr–Jun 2025 | 28 Jul 2025 | 11 Aug 2025 |

Check for any changes on the ATO’s website near the due date.

For a comprehensive overview of all BAS due dates in 2025, visit https://taxtracker.com.au/bas-due-dates-2025-overview.

Submission Tips

- Set calendar alerts

- Use accounting tools to generate BAS fast

- Lodge early if you’re due a refund

- Reconcile accounts monthly to save time

Additional Resources and Tips

How to lodge BAS, BAS reporting obligations, GST reporting for small businesses

Useful Links

Pro Tips

- Do bookkeeping weekly — don’t wait until BAS time

- Use cloud software to link your bank transactions and auto-calculate GST

- Stay up to date with any rule changes from the ATO

- Back up your data regularly

When to Get Professional Help

Consider hiring a BAS or tax agent if:

- You’re unsure how to fill your BAS

- You need more time

- You’d rather focus on your core business

They’ll help you stay compliant and error-free.

Conclusion

Knowing how to lodge BAS correctly helps your business stay legal and stress-free.

Let’s recap:

- Your BAS is a tax form from the ATO to report GST, PAYG and more.

- If you’re registered for GST, you must lodge a BAS.

- Lodging can be done online, with a tax agent, or via paper form.

- Follow the due dates to avoid penalties.

- Use tools and routines to file accurately and on time.

Proactive handling of BAS reporting obligations supports smoother operations and long-term business success.

Need help lodging your BAS? Contact our expert team for professional support.

FAQs

- 1. How often do I need to lodge my BAS?

Most businesses lodge their BAS quarterly, but some may lodge monthly depending on turnover or ATO requirement. - 2. What happens if I miss my BAS deadline?

You may receive penalties such as Failure to Lodge fees and interest on outstanding amounts. Contact the ATO immediately. - 3. Can I amend my BAS after lodging?

Yes. You can revise a BAS through the same platform where it was lodged. - 4. Do I need special software to lodge my BAS online?

No, but tools like Xero or SleekBooks simplify the process and reduce errors. - 5. Can I get an extension for lodging my BAS?

Yes, in special cases (e.g., natural disasters), ATO may give extensions. You must request it. - 6. Do I need to lodge BAS if my business isn’t registered for GST?

No, unless you have other tax obligations like PAYG withholding.

By understanding how to lodge BAS and following this guide, you’ll stay organized, compliant, and ready for every tax period. Happy lodging!

Pingback: Fuel Tax Credit Calculator: Your Ultimate Guide to Maximizing Business Tax Benefits – Tax Tracker Pty Ltd

Pingback: The Complete Guide to Sole Trader Tax Returns in Australia – Tax Tracker Pty Ltd