FBT Registration: A Clear Guide for Australian Employers

Estimated reading time: 9 minutes

Key Takeaways

- What is FBT?: Fringe Benefits Tax (FBT) is a tax paid by employers on certain non-cash benefits provided to employees or their associates. Understanding its scope is crucial.

- Registration is Mandatory: If you provide taxable fringe benefits, FBT registration with the Australian Taxation Office (ATO) is not optional. Timely registration helps avoid penalties.

- Record Keeping is Essential: Accurate and detailed records are fundamental for calculating FBT liability correctly and substantiating claims for exemptions or concessions.

- Deadlines Matter: Be aware of the FBT year (1 April to 31 March) and the due dates for lodging FBT returns and making payments.

Table of Contents

- FBT Registration: A Clear Guide for Australian Employers

- Key Takeaways

- Understanding FBT and Its Importance

- What Qualifies as a Fringe Benefit?

- Who Must Register for FBT?

- When is FBT Registration Required?

- Navigating the FBT Registration Process

- Life After Registration: FBT Compliance Essentials

- Reducing Your FBT: Exploring Exemptions and Concessions

- FBT Snapshot: Australia vs. New Zealand

- Common Pitfalls in FBT Registration (and How to Sidestep Them)

- Frequently Asked Questions (FBT)

For Australian employers, providing perks beyond salary and wages can be a great way to attract and retain talent. However, these “fringe benefits” come with tax obligations. Understanding FBT registration and ongoing FBT compliance is essential to meet your legal duties and manage costs effectively.

Understanding FBT and Its Importance

Fringe Benefits Tax (FBT) is a tax levied on employers for most non-cash benefits provided to their employees or their employees’ associates (e.g., family members). The core purpose of FBT is to ensure that all forms of remuneration are taxed, whether paid in cash or as a benefit. Ignoring FBT can lead to significant penalties and interest charges from the ATO.

What Qualifies as a Fringe Benefit?

Fringe benefits can take many forms. Common examples include:

- Company Cars: Providing a car that an employee can use for private travel.

- Car Parking: Providing car parking spaces for employees at or near the workplace.

- Entertainment: Expenses related to entertainment, such as meals, drinks, social functions, or tickets to events.

- Loan Benefits: Providing employees with low-interest or interest-free loans.

- Debt Waiver Benefits: Waiving or forgiving an employee’s debt.

- Housing Assistance: Providing accommodation or subsidised housing.

- Living-Away-From-Home Allowance (LAFHA): Payments to compensate employees for additional expenses incurred because they are required to live away from their usual place of residence for work.

- Expense Payments: Reimbursing or directly paying for an employee’s private expenses (e.g., school fees, health insurance premiums, phone bills with significant private use).

- Property Benefits: Providing goods or services to employees for free or at a discount.

Who Must Register for FBT?

Any employer in Australia (including companies, trusts, partnerships, sole traders, and government bodies) that provides taxable fringe benefits to its employees or their associates is generally required to register for FBT. If you are unsure whether the benefits you provide are subject to FBT, it’s best to seek professional advice. Learn more about small business tax obligations here.

When is FBT Registration Required?

You should register for FBT as soon as you determine that you will be providing fringe benefits that will result in an FBT liability. Ideally, this is done before you start providing these benefits, or at least by the end of the FBT year (31 March) in which the benefits are first provided. For specific timing guidance related to your business situation, click here for tax return insights.

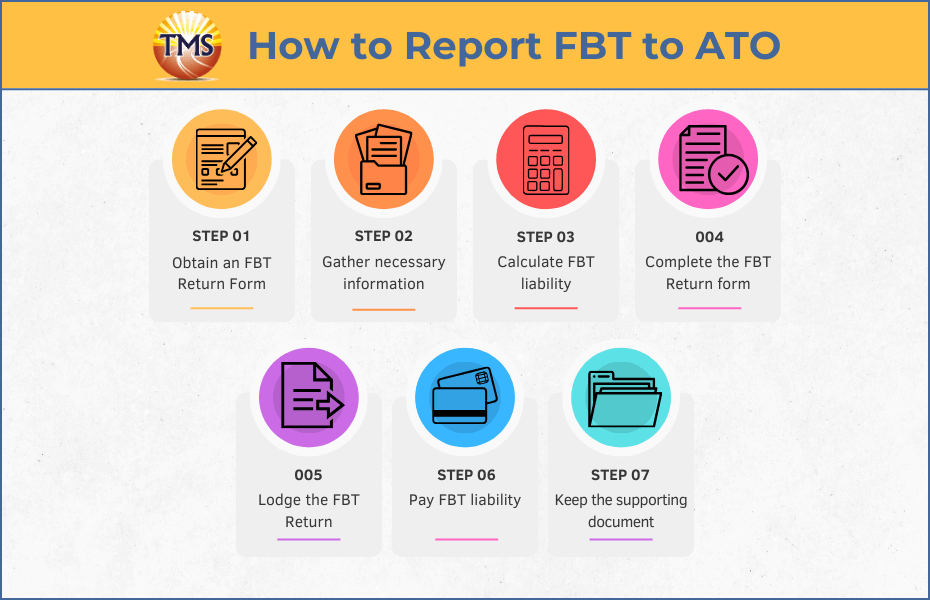

Navigating the FBT Registration Process: Step by Step

Registering for FBT is typically done through the Australian Taxation Office (ATO). You can register:

- Online through the Australian Government’s Business Registration Service.

- Through your registered tax agent or BAS agent.

- By phone if you are an authorised contact for the business.

For a comprehensive guide on lodging business activity statements (BAS), which can be related to FBT payments, check out this BAS guide.

Life After Registration: FBT Compliance Essentials

Once registered, your FBT compliance journey begins. Key responsibilities include:

- Calculating FBT Liability: You need to determine the taxable value of all fringe benefits provided. Different valuation rules apply to different types of benefits.

- Record Keeping: Maintain detailed records for at least five years. This includes documents like logbooks for cars, employee declarations, invoices, and calculations. Effective record-keeping is crucial. Find more information on BAS agent services and record-keeping here.

- Lodging FBT Returns: Lodge an FBT return annually if you have an FBT liability or if the ATO requires you to lodge (even for a nil liability). The FBT year runs from 1 April to 31 March.

- Paying FBT: Pay any FBT due by the prescribed date (typically 21 May, unless lodging through a tax agent, which may provide an extension).

Reducing Your FBT: Exploring Exemptions and Concessions

The good news is that not all benefits are subject to FBT, and some concessions can reduce your liability. Understanding available exemptions and concessions is key. Examples include:

- Work-Related Items: Items like portable electronic devices (laptops, mobile phones) primarily used for work, tools of trade, and protective clothing are often exempt.

- Minor Benefits: Benefits that are infrequent, irregular, and have a taxable value of less than $300 (inclusive of GST) per employee may be exempt.

- Specific Industry Concessions: Certain industries (e.g., not-for-profits, public hospitals) may have access to specific FBT concessions or exemptions.

Always check the specific eligibility criteria for any exemption or concession.

FBT Snapshot: Australia vs. New Zealand

While both Australia and New Zealand have FBT systems, there are notable differences. These can include tax rates, the types of benefits that are taxable, valuation rules, exemption thresholds, and administrative requirements. Employers with operations in both countries must be aware of and comply with each jurisdiction’s specific FBT laws.

Common Pitfalls in FBT Registration (and How to Sidestep Them)

- Failure to Register: The most basic mistake is not registering for FBT when liable. This often happens due to a misunderstanding of what constitutes a fringe benefit. Solution: Review all employee benefits against ATO guidelines or seek advice.

- Incorrectly Identifying or Valuing Benefits: Using the wrong valuation rules or failing to identify all taxable benefits can lead to incorrect FBT calculations. Solution: Familiarise yourself with the different benefit categories and their specific valuation rules.

- Poor Record-Keeping: Insufficient records make it difficult to calculate FBT accurately and can cause problems during an ATO audit. Solution: Implement a robust record-keeping system from day one.

- Missing Deadlines: Late lodgement or payment can result in penalties and interest. Solution: Diarise FBT deadlines and consider using a tax agent for reminders and assistance.

Proactive FBT management and a clear understanding of your obligations are the best ways to avoid these common errors.

Frequently Asked Questions (FBT)

Disclaimer: This article provides general information only and does not constitute financial or tax advice. Employers should seek professional advice from a registered tax agent or the ATO for matters relating to their specific circumstances.